As tensions rise between the U.S. and China over technology dominance, Thailand is seizing the opportunity to position itself as a key player in the global semiconductor industry. The country is fast-tracking its strategic plan for the semiconductor sector, with an initial draft expected in the next 90 days, aiming to attract new investments from international chip manufacturers.

Thailand’s Push for Semiconductor Growth

Thailand’s Board of Investment (BOI) is actively working on initiatives to boost the country’s semiconductor industry. Secretary-General Narit Therdsteerasukdi revealed that the BOI will hire a consulting firm to develop a roadmap for the sector. Additionally, investment roadshows in the U.S. and Japan are being planned to draw semiconductor companies into the Thai market.

With the U.S. imposing fresh tariffs on Chinese imports under President Donald Trump’s administration, businesses are looking for alternative manufacturing hubs. Thailand is strategically positioning itself as an attractive destination for semiconductor production, leveraging its stable economic policies and neutral stance in the trade war.

A Record Year for Investments in Thailand

In 2024, Thailand saw a 35% increase in inbound investment applications, reaching a 10-year high of 1.14 trillion baht ($33.5 billion). The government expects 2025 to surpass this figure, driven by a surge in investments in the electronics and digital sectors.

According to a 2024 report by consulting firm A.T. Kearney, Thailand ranks second behind India among emerging economies for semiconductor manufacturing. The country has set an ambitious target of securing 500 billion baht in semiconductor investments by 2029.

Why Thailand? Competitive Advantages Over Rivals

Thailand is focusing on power electronics, particularly semiconductors used in electric vehicles, data centers, and energy storage systems. This strategic direction aligns with global trends, making the country a competitive option for semiconductor firms looking to diversify their supply chains.

Several international companies, including Analog Devices (U.S.), Sony and Toshiba (Japan), and Infineon (Germany), already have semiconductor-related facilities in Thailand. Additionally, Foxsemicon Integrated Technology, a subsidiary of Taiwan’s Foxconn, has announced new projects in the country.

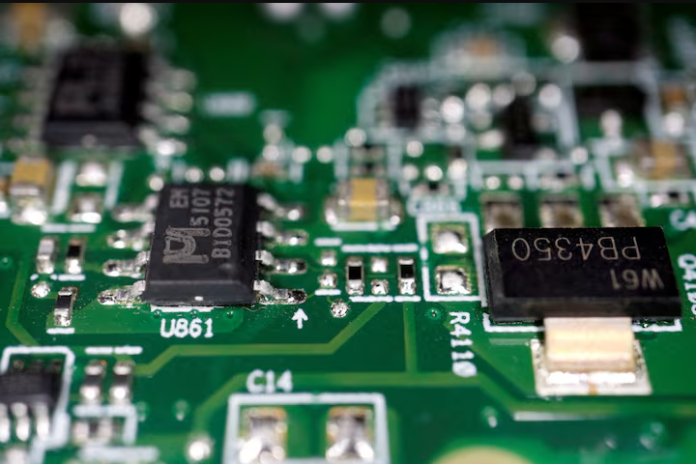

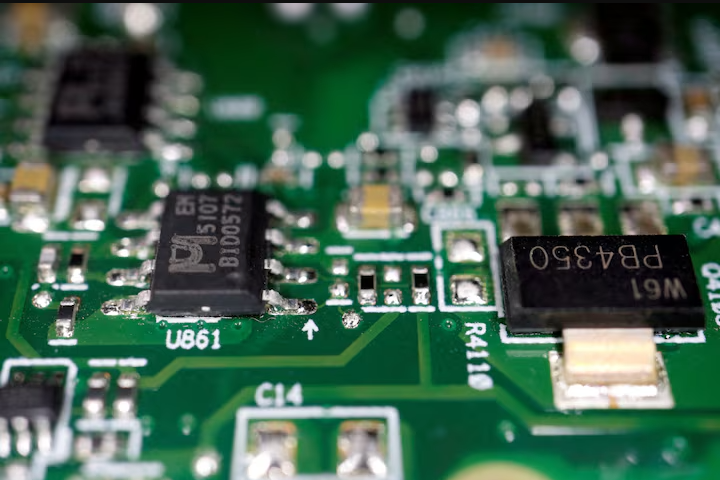

The production of printed circuit boards, essential components in various electronic devices, has also seen significant growth in Thailand since 2023, further strengthening its position as an electronics manufacturing hub.

Competing with Regional Players

While Thailand is making significant strides, it faces stiff competition from Malaysia, which dominates global semiconductor testing and packaging, accounting for 13% of the market. Malaysia is also targeting over $100 billion in chip sector investments.

However, Thailand’s neutral geopolitical stance and growing reputation as a manufacturing hub are attractive to investors seeking stability amid the ongoing trade tensions.

Conclusion

With a strong push from the government, a strategic roadmap in development, and increasing interest from international semiconductor firms, Thailand is well-positioned to capitalize on the shifting dynamics in the global chip industry. As companies look for alternatives to China, Thailand’s efforts could make it a major player in the semiconductor supply chain in the coming years.