The Consumer Financial Protection Bureau (CFPB) has shut down its Washington, D.C., headquarters until February 14, instructing employees to work remotely amid growing concerns over the agency’s future. The move follows a series of drastic decisions by newly appointed acting CFPB Director Russell Vought, including the suspension of nearly all agency activities.

Massive Shakeup at the CFPB

According to a memo from CFPB Chief Operating Officer Adam Martinez, employees were told to work from home due to the closure of the agency’s headquarters. The decision comes after Vought’s first official email, in which he ordered a freeze on the CFPB’s oversight of financial firms—one of its core functions.

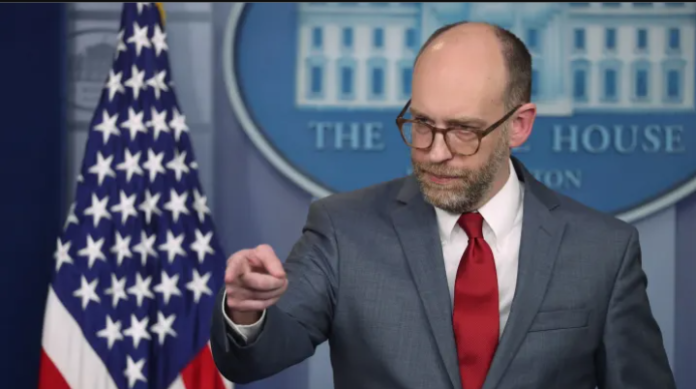

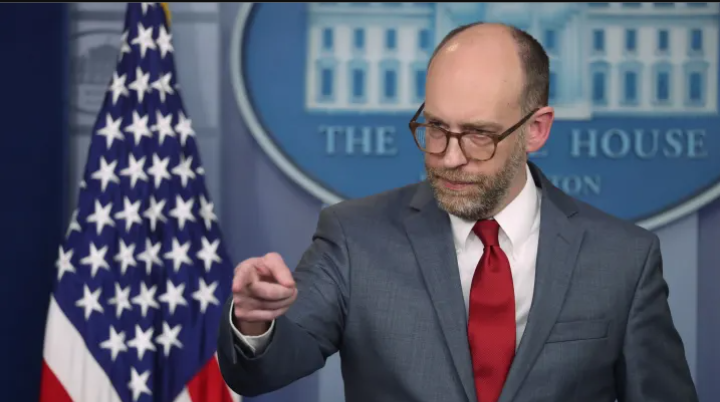

Vought, who was recently confirmed as President Donald Trump’s new Director of the Office of Management and Budget (OMB), has played a key role in Project 2025, a strategic plan aimed at reshaping the federal government. His appointment signals a significant policy shift that could redefine the role of the CFPB.

Elon Musk Joins the Fight Against the CFPB

Adding to the controversy, Elon Musk—who has been vocal about his opposition to the CFPB—posted “CFPB RIP” on his social media platform, X. Musk has previously advocated for eliminating the CFPB, arguing that the agency operates with little accountability.

Sources have revealed that operatives from Musk’s DOGE team were given access to CFPB data, including staff performance records, raising concerns about the agency’s security and independence. Meanwhile, Vought announced on X that he is halting new funding to the CFPB, calling it a step toward ending the agency’s financial independence.

CFPB Employees Fear Mass Layoffs

With nearly 1,700 employees, the CFPB now faces an uncertain future. Insiders suggest that only a few hundred positions are legally required to exist, leaving many staff members vulnerable to layoffs or administrative leave.

The agency, originally established after the 2008 financial crisis, plays a critical role in protecting consumers from unfair financial practices. However, its critics—especially within the banking industry—have long accused it of overreach.

Consumer Protections at Risk

If the CFPB is weakened or dismantled, several key initiatives designed to protect consumers could be lost. These include:

- Limits on credit card and overdraft fees, which were expected to save Americans billions.

- A rule that would have removed $49 billion in medical debt from the credit reports of 15 million people.

With the agency’s operations now in limbo, consumer advocates warn that millions of Americans could lose crucial financial protections.

What’s Next?

As the February 14 deadline approaches, CFPB employees and the financial sector await further announcements. Will the CFPB survive, or is this the beginning of its dismantling? One thing is certain—the fight over consumer protection is far from over.